Access Bank is a Nigerian multinational corporation and commercial bank licensed by the Central Bank of Nigeria. As one of the five largest banks in Nigeria in terms of assets, loans, deposits, and branch networks, Access Bank extends its services via internet-enabled devices. With the introduction of Access Bank transfer codes, customers enjoy more convenient measures of the instant banking system.

One particular thing that customers can enjoy is transferring money in a multitude of ways. With technological advancement, the process is quite easy, from using a mobile app to using transfer codes to send funds to a client, friend or relatives, although some of these means require more information than others. Given that, we are here to acquaint you with how to use the various Access Bank transfer codes, internet, and mobile banking provisions and utilize the services the Access Bank customer care unit offers.

- What is Access Bank Transfer Code?

- What Are The Functions Of The Access Bank Transfer Codes?

- Benefits of Using Access Bank Transfer Codes

- How To Create Your Access Bank Transfer PIN

- Things You Can Use The Transfer Code To Do

- 1. Transfer Money

- 2. Buy Airtime

- 3. Opening New Access Bank Account

- 4. Verifying Access Bank Account Number

- List of All Access Bank USSD Codes

- What Are Sort Codes and SWIFT Codes?

- How Access Bank Sort Codes and Swift Codes Work

- Where Can One Find Access Bank Sort/SWIFT Code?

- A Complete List of Access Bank Sort Codes For Each State

What is Access Bank Transfer Code?

Mobile banking has improved significantly to allow easy access to banking services through the use of USSD Codes. Access bank has also leveraged this new trend to provide faster transaction services to its customers. One of the bank’s laudable feats is its introduction of the *901# USSD Code.

The Access bank transfer code has helped make money transfer operations much more straightforward for customers as it enables sending and receiving money on the spot. This mobile money transfer system makes it possible to send money from one account to another, any time, any day, and anywhere.

What Are The Functions Of The Access Bank Transfer Codes?

The Access bank transfer code provides the customer with different ways of making more banking transactions. It helps to make your day less stressful and allows you to do more with the bank while staying at home. Below is a list of all the things you could do with Access bank’s *901# code:

- Account Opening

- BVN and email Updates

- Bills Payment

- Changing PIN

- Blocking your stolen ATM cards

- Money Transfers

- Airtime Recharge

- Check Account Balances

Benefits of Using Access Bank Transfer Codes

Using the Access Bank transfer code, like every other bank’s transfer code, comes with lots of benefits:

- It makes bank transactions easier, faster, and convenient

- The code is compatible with all phone types

- You do not need mobile data to operate it

- Transaction process is less than 20 seconds

- The service is available 24 hours a day, 7 days a week.

- The service is available to all networks in the country – Airtel, 9mobile, GLO, and MTN subscribers

How To Create Your Access Bank Transfer PIN

To start using the Access bank USSD code, you must first activate it by getting your transfer pin. To begin the process of getting a transfer pin, there are some basic requirements you must meet

- Have an Access bank account number

- Have a phone number that is registered or linked to your account

- Have an ATM card

- Prepare a four (4) digit unique pin you would need to replace the default pin

Having met the above-listed requirements, follow these steps to activate the Access Bank transfer code

- Dial *901# with your registered phone number and click on ‘Transfer’

- Enter the last 6 digits of your Debit Card number (if you do not have an active debit card, you will be prompted to input your registered Date of Birth).

- Enter your account number and click send

- Create a 4-digit PIN

Note: There is no bank charge attached to this process. It is free of charge

Things You Can Use The Transfer Code To Do

1. Transfer Money

Access bank transfer code allows you to make a transfer of money either to another Access bank account or to a client with a different bank account like First bank, Fidelity bank, or Eco bank.

- To transfer money to another Access bank accounts – Dial *901*1*AMOUNT*NUBAN Account Number#. Eg: *901*1*10000*1234567890# for a transfer of N10,000.

- To transfer money from your Access bank account to a different bank account, dial *901*2*AMOUNT*NUBAN Account Number#. Eg: *901*2*10000*1234567890#

Note: Access bank charges N20 for every money transferred within two of its customers (Access bank to Access bank). Transfers to other banks cost N10 (for N5000 and below), N25 (for N50,000 and below), N50 (above N50,000).

2. Buy Airtime

You can buy airtime on any network from your bank account using the Access Bank transfer code. What’s more interesting about this is that it is free of charge.

Self Airtime: To purchase airtime to your own phone number that is linked with Access bank, dial *901*amount# For example: *901*200# for an airtime transfer of N200.

For Someone Else: To purchase airtime for another SIM card that is NOT linked with your account, such as your other SIM, someone else’s number like friends, family, etc, dial *901*amount*phone number# Example: *901*200*08104xxxxxx#.

3. Opening New Access Bank Account

You don’t need to visit the bank to open a new bank account with Access Bank. The introduction of the shot code has made the process easier. Use the following steps:

- Dail the Access Bank short code *901# on your mobile phone and follow the instructions on the screen.

- Enter your first name as requested, then send.

- Type your last name and send. Please make sure that your names are written correctly.

- Follow the on-screen prompts to complete your registration.

4. Verifying Access Bank Account Number

To check your Access Bank account number with the transfer code, use the following steps.

- Simply Dial *901# on your phone number linked to your access bank account.

- Enter “5” and press send.

- Wait for a few minutes.

- You will receive an SMS from Access Bank with your account balance

Note: There is a bank charge for this process. Access bank charges N10 for every account balance inquiry.

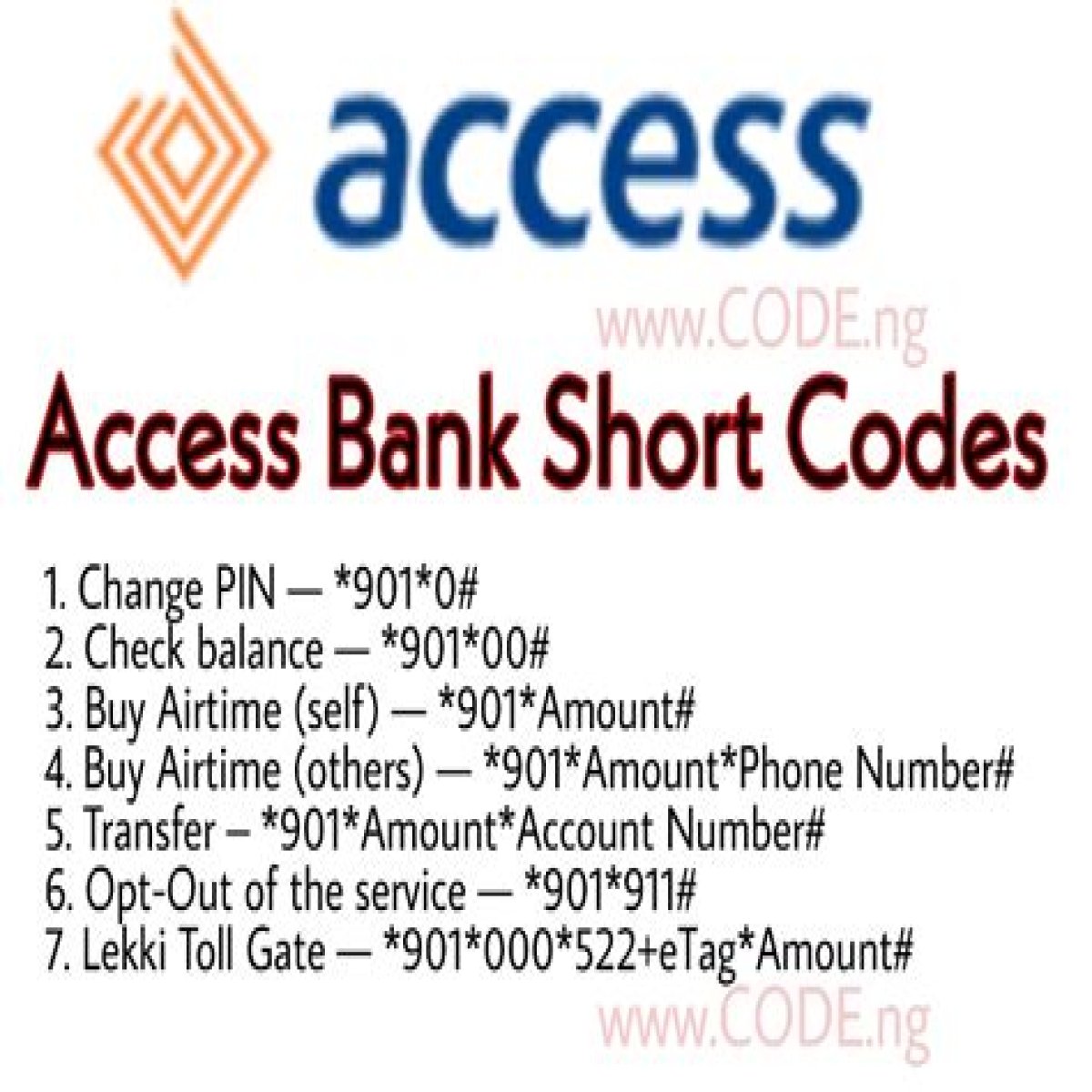

List of All Access Bank USSD Codes

| S/N | Short Strings | Function |

|

1 |

*901*1*merchant code*amount# | Merchant payment |

|

2 |

*901*amount# | Self-airtime purchase |

|

3 |

*901*Amount*Phone Number# | Airtime to others |

|

4 |

*901*Amount*Account Number# | Transfer |

|

5 |

*901*00# | Balance inquiry |

|

6 |

*901*0# | PIN change/reset |

|

7 |

*901*000*522+etag number+amount# | LCC Toll account top-up |

|

8 |

*901*911# | To deactivate the phone number on USSD (this service can be accessed via any phone or phone number). |

|

9 |

*901*3# | Bill Payments |

|

10 |

*901*000*RefCode# | USSD on POS |

|

11 |

*901*5# | Diamond Xtra |

|

12 |

*901*11# | Payday Loan |

|

13 |

*901*14# | Dual Transaction Service (DTS) |

|

14 |

*901*10# | Access Yellow |

|

15 |

*901*13# | Access Africa |

|

16 |

*901*12# | Update customer info |

What Are Sort Codes and SWIFT Codes?

A sort code is a number used to identify both the bank and the branch where an account is held. The sort code is usually used when transferring funds from one account in one bank branch to another branch of the bank or another bank. A sort code can be located at the bottom of a bank’s cheque booklet.

A swift code, on the other hand, is an alternate format of a Bank Identification Code (BIC). It was created by the Society for Worldwide Interbank Financial Telecommunication network and is used to identify a bank location, country, and branch number when initiating an international transfer.

How Access Bank Sort Codes and Swift Codes Work

While sort codes are made up of 9 numbers divided into 3 pairs, for example, 123-456-789; swift codes are a bit more complicated as they can range from 8 to 11 alphanumeric characters.

Access bank, like every other Nigerian bank, uses an eight (8) character swift code that is meant for a bank head office while the eleven (11) character codes are for the other branches of the bank.

Sort codes are used to transfer money between domestic banks and financial institutions only. They work by identifying accounts and providing instructions needed to route money transfers domestically within clearance organizations.

Swift codes are passed between banks and non-financial corporations in a secure, encrypted way. Funds are not physically transported using the SWIFT network, only the instructions; this communication facilitates the money transfer.

Where Can One Find Access Bank Sort/SWIFT Code?

Access bank has more than 300 branches in the country, and each of these bank branches has its own sort code. You can find Acces bank’s sort code on bank-issued cards, statements, and online banking. The code can also be seen in the bank’s cheque books.

The SWIFT Code for Access Bank Nigeria is ABNGNGLA. This code, which is valid irrespective of the branch in which you opened your Access Bank account, can be found on bank statements and by logging into online banking accounts. Alternatively, you can contact Access bank customer care directly to confirm the SWIFT code.

Note: Since Diamond has now merged with Access Bank, all previous Diamond bank customers will also have to use ABNGNGLA as their Swift Code.